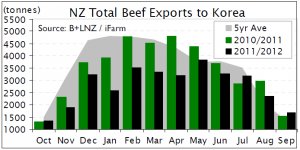

Domestic supplies have lifted partly due to Government intervention to reduce livestock numbers and stymie price falls. Mid year, the Korean cattle herd hit a record 3.5 million head and the Government wants to lower this to 2.6 million by the end of 2013. For the first 9mths of the year, beef imports were back 16% according to Korea International Trade Association. Australia is the largest supplier with a 50% share, while the US has a 38% and NZ an 11% share. Australian beef exports to South Korea for the first 9mths of the year were back 25% or 27,000 tonnes while New Zealand beef exports to Korea were down 20% or 6,500 tonnes.

Australian beef displaced

Australian beef exports to the US have been up this year as exporters have taken advantage of high lean grinding beef prices. When compared to last year, there is generally more beef available from Australia for export. The AU dollar has made trading difficult however this has been a similar case with other countries Australia exports to, in particular Russia, where the AU dollar has climbed significantly against the Russian Rouble. This has been another reason for the lift in exports to the US, as Australian beef is being displaced by Brazilian and Uruguayan beef, partly because they favour a better cross rate with the Russia Rouble.

Australia number one supplier of US imported beef

US imports this year have not been as robust as originally expected, especially from Canada. US beef imports from Canada this year to Oct 22 have been 154,000 tonnes, 17% below last year's low volumes. Since 2008, Canada has been the number one supplier of the US imported beef market, however Australia has upped their shipments by 46% this year to 166,000 tonnes which surpasses Canadian imports. Steiner consulting projects that Australian shipments for October alone will be up 47% to around 18,000 tonnes. Beef imports from NZ are not far behind in volume for the year, having increased a further 6% on last year's volumes to 140,000t.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |